HONG KONG — China outlined new curbs on exports of rare earths and related technologies on Thursday, extending controls over use of the elements critical for many high-tech and military products ahead of a meeting in about three weeks between President Donald Trump and Chinese leader Xi Jinping.

The regulations announced by the Ministry of Commerce require foreign companies to get special approval to export items that contain even small traces of rare earths elements sourced from China. These critical minerals are needed in a broad range of products, from jet engines, radar systems and electric vehicles to consumer electronics including laptops and phones.

Beijing will also impose permitting requirements on exports of technologies related to rare earths mining, smelting, recycling and magnet-making, it said.

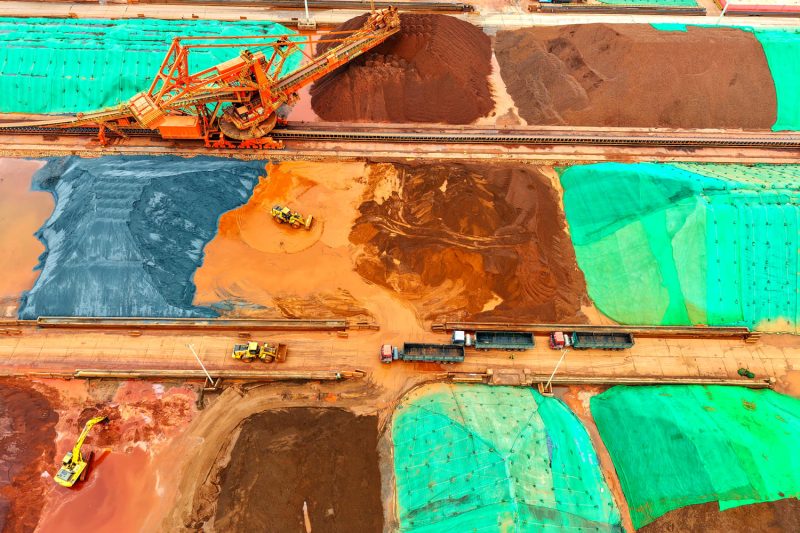

China accounts for nearly 70% of the world’s rare earths mining. It also controls roughly 90% of global rare earths processing. Access to such materials is a key point of contention in trade talks between Washington and Beijing.

As Trump has raised tariffs on imports of many products from China, Beijing has doubled down on controls on the strategically vital minerals, raising concerns over potential shortages for manufacturers in the U.S. and elsewhere.

It was not immediately clear how China plans to enforce the new policies overseas.

During a cabinet meeting Thursday, Trump said he had yet to be briefed on the new rules but suggested that the U.S. could stop buying Chinese goods. “We import from China massive amounts,” Trump said. “Maybe we’ll have to stop doing that.”

Neha Mukherjee, a rare earths analyst at Benchmark Mineral Intelligence, called the new export controls “a strategic move by China that mirror some of Washington’s new chip export rules.

“Most rare earth magnet manufacturers in the U.S., Japan and elsewhere remain heavily dependent on rare earths from China, so these restrictions will force some difficult decisions — especially for any company involved in military uses of rare earths because most of those export licenses are expected to be denied, he said.

“The message is clear: if the U.S. and its allies want supply chain security, they must build independent value chains from mine to magnet,” Mukherjee said.

The new restrictions are to “better safeguard national security” and to stop uses in “sensitive fields such as the military” that stem from rare earths processed or sourced from China or from its related technologies, the Commerce Ministry said.

It said some unnamed “overseas bodies and individuals” had transferred rare earths elements and technologies from China abroad for military or other sensitive uses which caused “significant damage” to its national security.

The new curbs were announced just weeks ahead of an expected meeting between Trump and Chinese President Xi Jinping on the sidelines of the Asia-Pacific Economic Cooperation forum in South Korea, that begins at the end of this month.

“Rare earths will continue to be a key part of negotiations for Washington and Beijing,” George Chen, a partner at The Asia Group, said in an emailed comment. “Both sides want more stability but there will be still a lot of noises before the two leaders, President Trump and Xi, can make a final deal next year when they meet. Those noises are all negotiation tactics.”

These new restrictions will likely prompt additional government and private investments in developing a mine-to-magnet supply chain outside of China. Mukherjee said that $520 million of investments in the American rare earths industry were announced just in the second quarter with most of that coming from the government.

And there is some progress already being made with American magnet maker Noveon announcing an agreement with Lynas Rare Earths this week to secure a supply of rare earths outside of China from Lynas’ mine in Australia, and MP Materials preparing to begin producing magnets later this year at its new plant in Texas that uses rare earths from the only U.S. mine that it operates in California.

In July, the U.S. Defense Department agreed to invest $400 million in shares of the Las Vegas company, establish a floor for the price of key elements, and ensure that all of the magnets made at a new plant in the first 10 years are purchased.

An MP Materials spokesperson said China’s action “reinforces the need for forward-leaning U.S. industrial policy. Building resilient supply chains is a matter of economic and national security.”

Wade Senti, president of the U.S. permanent magnet company AML, said it’s time to innovate.

“The game of chess that China is playing underscores the importance of developing innovation that changes the game and puts the United States in leading position,” Senti said.

Nazak Nikakhtar, a former Commerce Department undersecretary, said the new restrictions are “a significant development and escalation” by extending controls to related technology and equipment and to sectors like chipmakers. “This should be a wake-up call to the U.S. government that we need to invest in and appropriate more to domestic capabilities. Both are critical to rebuild America’s rare earths industrial base,” she said.

In April, Chinese authorities imposed export curbs on seven rare earth elements shortly after Trump unveiled his steep tariffs on many trading partners including China.

While supplies remain uncertain, China approved some permits for rare earth exports in June and said it was speeding up its approval processes.