Sector Rotation: Financials Climb as Consumer Discretionary Slips

While the players in the top five sectors have remained the same, we can see some movement in their relative positions. Communication services continue to lead the pack, but financials have climbed to second, nudging consumer discretionary down to third. Technology and utilities are holding steady at fourth and fifth, respectively.

In the bottom half of the ranking, consumer staples has overtaken industrials, claiming sixth place. The remaining positions, from eight to eleven, have stayed the same.

- (1) Communication Services – (XLC)

- (3) Financials – (XLF)*

- (2) Consumer Discretionary – (XLY)*

- (4) Technology – (XLK)

- (5) Utilities – (XLU)

- (7) Consumer Staples – (XLP)*

- (6) Industrials – (XLI)*

- (8) Energy – (XLR)

- (9) Real-Estate – (XLRE)

- (10) Healthcare – (XLV)

- (11) Materials – (XLB)

Weekly RRG

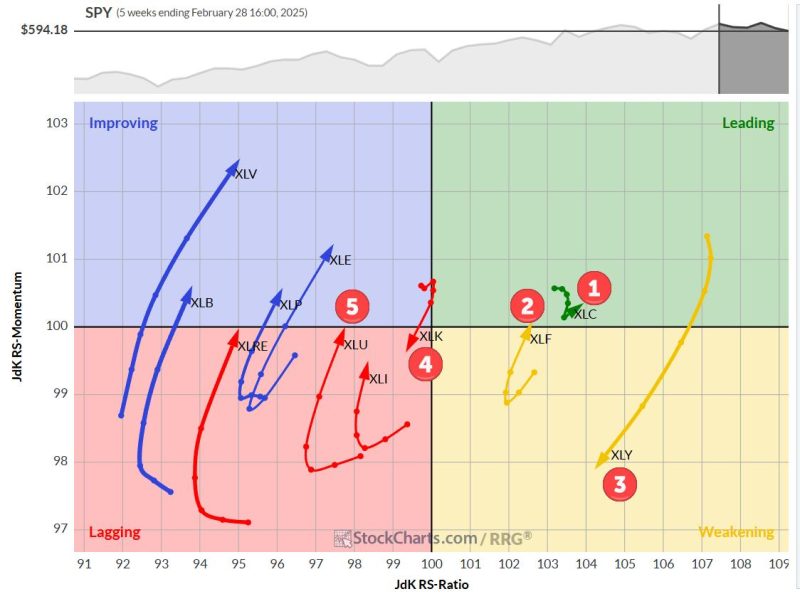

This week’s observations on weekly sector rotation:

- Communication services remain the lone wolf in the leading quadrant, with its recent node pointing back up — a positive sign for its continued dominance.

- Financials are on the cusp of re-entering the leading quadrant, showing an apparent turnaround.

- Consumer discretionary (XLY) is in the weakening quadrant but still has the highest RS-Ratio reading, potentially giving it ample room to reverse course.

- Technology has retreated to the lagging quadrant — not a great look, imho.

- While also in the lagging quadrant, Utilities shows a strong RRG heading and is close to moving into the improving quadrant.

Daily RRG

Switching to the daily RRG, we get some additional context for these rankings:

- Communication services is in the weakening quadrant with a negative heading, but its tail is short and its RS-Ratio remains strong.

- Financials is also in the weakening quadrant but starting to curl back up — it’ll be a close call whether it moves through lagging or not.

- Consumer discretionary is deep in the lagging quadrant, with the weakest RS-Ratio reading on the daily chart.

- Technology is in the leading quadrant but losing relative momentum.

- Utilities show strength in the leading quadrant, moving higher on the RS-Ratio scale.

Notably, consumer staples are making waves on the daily chart, with a strong move into the leading quadrant.

Spotlight on the Top Five

Let’s get back into the trenches and look at the individual charts for our top performers:

Communication Services – XLC

The sector is maintaining its rhythm of higher highs and higher lows, though there’s been some near-term deterioration. The old resistance line is now acting as support — a level to watch in the coming week.

Relative strength remains robust, with the raw RS line trending higher and the RS-Ratio confirming this upward movement. The RS-Momentum line appears to be bottoming around the 100 level, which could signal a potential turnaround.

Financials – XLF

Financials had a stellar week, closing at the top of its range and flirting with all-time highs. The raw RS line has already broken to new highs, and both RRG lines are turning upward. This sector is well-positioned to claim the top spot in the coming weeks potentially.

Consumer Discretionary – XLY

Things are looking a bit dicey for consumer discretionary. We’ve broken below the previous low, establishing a series of lower highs and lower lows. Support levels just below 210 and around 200 are now critical. The RS line has stalled and is moving lower, dragging both RRG lines down.

This sector must hold current price levels and reverse its relative strength decline to maintain its top-five status.

Technology – XLK

Technology is in a similar boat to consumer discretionary. It’s approaching a double support area around 220, with a rising support line and horizontal support from previous lows. The RS line is rolling over and breaking down — if it breaches the lower boundary of its range, we could see more relative downside. Both RRG lines have topped out and are moving below 100, creating that negative heading on the RRG.

Utilities – XLU

Utilities are bucking the trend of technology and consumer discretionary. It’s slowly but surely continuing its upward trajectory, maintaining that series of higher highs and higher lows. While still range-bound, the relative strength chart is starting to trend higher, pushing both RRG lines upward. It’s still in the lagging quadrant, with both RRG lines below 100, but the heading is strong.

Portfolio Performance Update

Unfortunately, we’ve lost the outperformance that was built up over the last few weeks. We’re now neck-and-neck with the benchmark—the RRG portfolio has gained 1.62% since inception, while the SPY has gained 1.68% over the same period.

#StayAlert, –Julius