“An investment in Knowledge pays the best interest.” — Benjamin Franklin

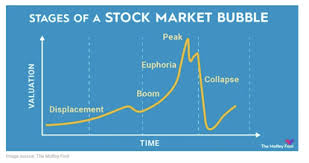

It’s time to revisit a few timeless lessons regarding extended markets.

As I write this, the last correction of any significance was in 2022. The past two years have been one heck of a dance if you chose to accept an invitation. For those of you attending, I remind you to remember your appropriate dance steps and keep your shoes shiny and polished or you’ll be asked to leave.

There’s perhaps no better way to achieve these objectives than revisiting the two stock market classics pertaining to frothy markets. I recommend reviewing two books, both entertaining and insightful:

- Charles Kindleberger’s book Manias, Panics and Crashes: A History of Financial Crises (7th edition)

- Charles MacKay’s book Extraordinary Popular Delusions and the Madness of Crowds

I have some personal observations I like to keep in mind on this topic.

- Major corrections are more a state of mind than a numeric calculation. It’s not all about the numbers.

- Alan Greenspan called it “irrational exuberance” that’s the sister of “FOMO”, which represents investors’ Fear of Missing Out. Smaller profits are better than big losses.

- When my grocery clerk and postal carrier corral me to talk about equities, my radar flashes.

- Sir John Templeton said, “The four most dangerous words in investing are: it’s different this time.” When the press is bursting with stories about the “New New Thing” — be it cryptocurrency or AI — my antenna stands tall. Hearing the cliche “it’s different this time” conjures up memories of the tech top in 2000, which many of us lived through.

- A good example is Nvidia (NVDA), on its towering popularity pedestal. I ask myself what might the unknown hazards and hidden future fractures be? Most certainly, the craters will reveal themselves over time. I’m paying attention. Will Nvidia profits truly grow for decades and competitors be kept at bay? As Carlos Slim Helu explained, “with a good perspective on history, we can have a better understanding of the past and present and thus a clear vision of the future.”

- Change is the DNA and indeed the lifeblood of the markets. New competitors will vault over established leaders, new technology will leapfrog existing technology, and today’s darlings will be passed by. Of the top twenty companies in the S&P 500 in the year 2000, only six remain. This change in leadership is to be expected. Fourteen have fallen out of the elite “Top 20” group. “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” — George Soros.

Always remember the timeless advice of Bernard Baruch, “Don’t try to buy at the bottom and sell at the top; it can’t be done except by liars.” The bottom line is this. Keep your trading shoes shiny and remember your essential investing dance steps. By doing so, you’ll enjoy a tremendous party without a hangover.

Trade well; trade with discipline!

Gatis Roze, MBA, CMT

- Author, “Tensile Trading: The 10 Essential Stages of Stock Market Mastery” (Wiley, 2016)

- Developer of the “Stock Market Mastery” ChartPack for StockCharts members

- Presenter of the best-selling “Tensile Trading” DVD seminar

- Presenter of the “How to Master Your Asset Allocation Profile DVD” seminar