Real Estate and Healthcare Swapping Positions in Top 5

The top five sectors show remarkable stability, with Consumer Staples, Utilities, Financials, and Communication Services holding steady in the top four positions. The only change is Real Estate replacing Health Care, a shift that underscores the ongoing defensive tilt in the market. In the bottom half of the ranking, Materials and Consumer Discretionary swapped positions.

- (1) Consumer Staples – (XLP)

- (2) Utilities – (XLU)

- (3) Financials – (XLF)

- (4) Communication Services – (XLC)

- (6) Real-Estate – (XLRE)*

- (5) Healthcare – (XLV)*

- (7) Industrials – (XLI)

- (9) Materials – (XLB)*

- (8) Consumer Discretionary – (XLY)*

- (10) Energy – (XLE)

- (11) Technology – (XLK)

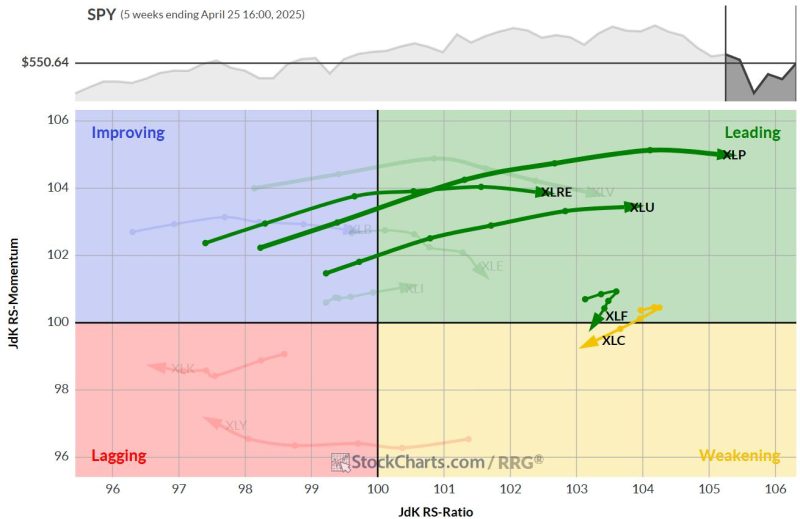

Weekly RRG

Looking at the weekly Relative Rotation Graph (RRG), we observe ongoing strength in Consumer Staples and Utilities. Both sectors are advancing further into the leading quadrant and continue to gain on the RS ratio axis.

Real Estate is also making a notable move deeper into the leading quadrant. Financials and Communication Services are positioned on the brink of the weakening quadrant. However, they are still sustaining elevated RS ratio levels, which keeps them securely in the top five — at least for now.

Daily RRG

- Consumer Staples and Utilities: Both reside within the weakening quadrant, but at high RS ratio levels. This combination, along with their strength on the weekly RRG, keeps them well inside the top five.

- Communication Services: Moved into the lagging quadrant but with a very short tail close to the benchmark. This positioning allows it to remain in the top five — for now.

- Financials: Similar to Communication Services, close to the benchmark with a slightly longer tail but not showing significant loss of relative strength.

- Real Estate: Made a significant move, pushing into the leading quadrant on the daily RRG, combining with its strong weekly tail to secure its spot in the top five.

Consumer Staples

The Consumer Staples sector remains range-bound on the weekly chart, causing relative strength to stabilize. With RRG lines at high levels, we might see some consolidation in the coming week — definitely something to keep an eye on.

Financials

Financials are picking up steam again, closing in the upper half of last week’s bar. This price strength is helping the relative strength line remain well within its rising channel. If the sector can maintain this momentum, it’s likely to stay among the top performers.

Utilities

Utilities are trading within their sideways channel, continuing to push relative strength against (or just above) resistance. This strength is keeping the RRG lines above 100. However, imho, we’ll need to see more relative strength in the coming weeks to keep Utilities at the top of the list.

Communication Services

Communication Services had a strong week, closing at the top of its range against former support, now acting as resistance. Based on the price chart, we might expect some resistance and difficulty for the sector to move higher this week. Despite this, the relative strength line remains within its rising channel, albeit losing some relative momentum at high RS ratio levels — not concerning at this time.

Real Estate

Real Estate — the new entrant in the top five — is benefiting from a strong bounce off the $36 low two weeks ago. It’s now starting to push relative strength higher, although not yet extremely strong. The RS momentum line is beginning to roll over while dragging the RS ratio higher.

For now, the combination of daily and weekly relative strength has been enough to displace Health Care and secure Real Estate’s spot in the top five.

Portfolio Performance

The defensive positioning of our portfolio has put a dent in performance relative to the broader market. We’re now trailing the S&P 500 by almost 3%. However, we’ve seen over the past few weeks that these differences can equalize rapidly when the market moves in the direction of the portfolio. So, I’m not too concerned at the moment — it’s all part of the ebb and flow of market dynamics.

#StayAlert and have a great week –Julius