Generally, there are 3 key hedges against inflation – gold ($GOLD), commodities ($XRB), and real estate (XLRE). While the Fed has taken a renewed interest in the short-term rising inflationary picture, which, by the way, is in direct contrast to what Fed Chief Powell said in late August and September, Wall Street simply isn’t seeing the same picture. Talk is cheap. When it comes to the stock market, the true statement being delivered is reflected in the price chart, not on CNBC.

Everyone now seems to be taking a different trading stance too. Bonds have been sold, sending yields soaring again. Bond investors will sell bonds when inflation is center stage for one simple reason. Bond yields aren’t high enough, given the prospects of inflation, and bond investors demand a higher yield to take on the additional inflation risk. After all, do you want to hold a 4% 10-year treasury if you believe inflation might move to 6%? I’d hope not. That’s clearly a losing proposition. Personally, I think the recent selloff in bonds is completely unwarranted and that yields will ultimately drop as investors fail to see meaningfully-higher inflation materialize.

The Fed has stated that it wants to continue watching inflation data and that its target rate of 2% will more likely be achieved in 2027 vs. 2026. While they’ve indicated that interest rate cuts will occur just two times in 2025 vs. the previously-announced 4 rate cuts, one question that should continue to be asked is…..why would interest rates be cut AT ALL if you’re truly worried about inflation. And why would the Fed have already cut the fed funds rate by 100 basis points over the past 3 Fed meetings? Honestly, I think this nonsense is nothing more than the Fed Chief hedging and waffling.

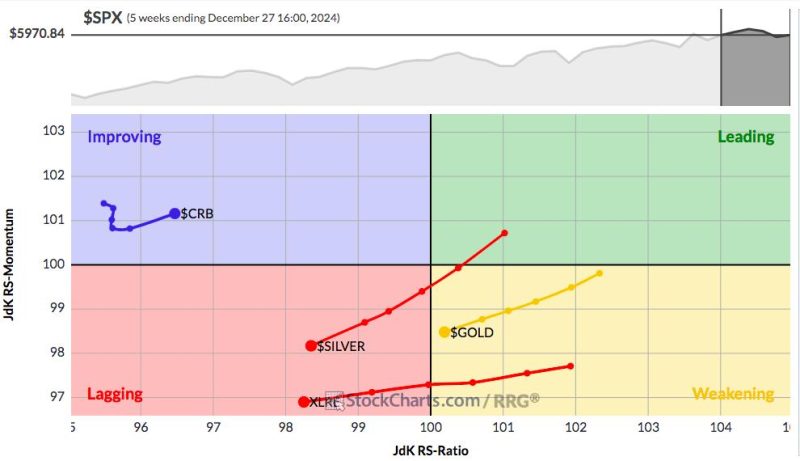

Is the stock market concerned about inflation? Ummm, I don’t think so. Let’s get back to those inflation “hedges” and see how they’ve been performing recently vs. the S&P 500. After all, when inflation, or the threat of inflation, is REAL, the hedges should work and outperform the benchmark S&P 500, right? Take a look at this current RRG chart (I’ve included silver as well):

Does this look like Wall Street is rotating into these hedges to you?

To compare, let’s go back to 2022 and check out when inflation was an obvious problem:

A 6.5% annual rate of inflation is a problem and that was certainly one big reason why we followed that up with a cyclical bear market in stocks (which I called at our MarketVision 2022 event in early January of that year). Now let’s check out the movement in the fed funds rate in 2022 and, more recently, in 2024:

When inflation is truly a problem, you RAISE the fed funds rate, you don’t cut it. 2022 saw the fed funds raised incredibly fast and the total increases were significant. The Fed was increasing rates to slow demand and curb inflationary pressures, which they did. But if we fast forward to late 2024, the Fed is CUTTING rates and is looking ahead and saying more rate cuts are coming. This DOES NOT happen when inflation is a true threat.

Now, scroll up and take a look at the current RRG chart that shows money rotating AWAY FROM inflation hedges. It’s quite a different look than when inflation is a REAL problem. Check out this RRG chart, which shows rotation in February 2022 as inflation establishes its first annual rate of change peak:

Quite a different look, wouldn’t you say?

So my last question…….Does Wall Street truly believe inflation is a major threat? I say no.

MarketVision 2025

Well it’s time and we’re only one week away. How will 2025 unfold? I have a solid track record at these prior MarketVision events. This is year #6. In the previous 5, I’ve provided bullish outlooks for 2020, 2021, 2023, and 2024, which were all bullish. The only year I was cautious was heading into 2022 and it was due to a number of factors, including inflation. But the biggest question right now is…..Where are our major indices heading in 2025? Which sectors and industry groups are likely to be in favor? What about the dollar and commodities? Interest rates and the yield curve? Sentiment? International stocks? I have the answers and I’ll be sharing them with our EarningsBeats.com members next Saturday, January 4, 2025 at 10:00am ET. For more information and to register for MarketVision 2025, CLICK HERE! We’ll provide you ONE YEAR of EarningsBeats.com membership FOR FREE when you sign up for the event!

4 Trading Tips for 2025

I want to open up a new year with 4 important trading tips to help make 2025 a more successful and profitable year. for you. You can SIGN UP for these tips and they will be delivered to your email, beginning on Monday, December 30th. I hope you enjoy them as a THANK YOU for your loyalty and support in 2024!

On behalf of the entire EarningsBeats.com team, I want to wish everyone a happy, healthy, and prosperous 2025!

Happy trading!

Tom